salt tax repeal new york

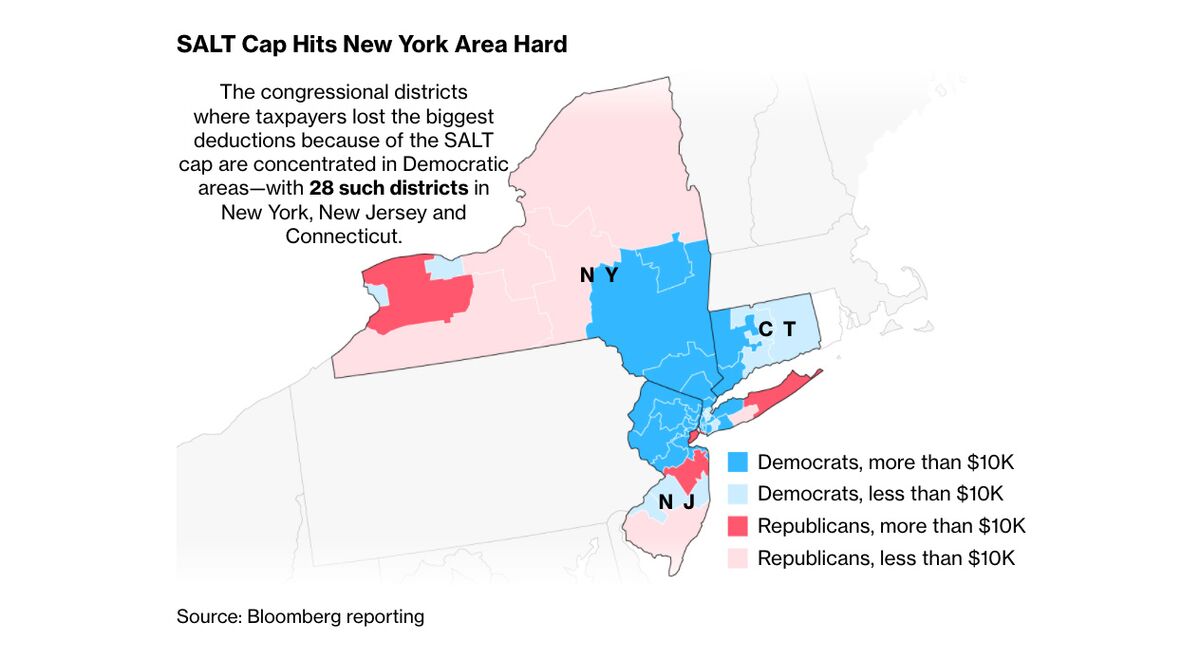

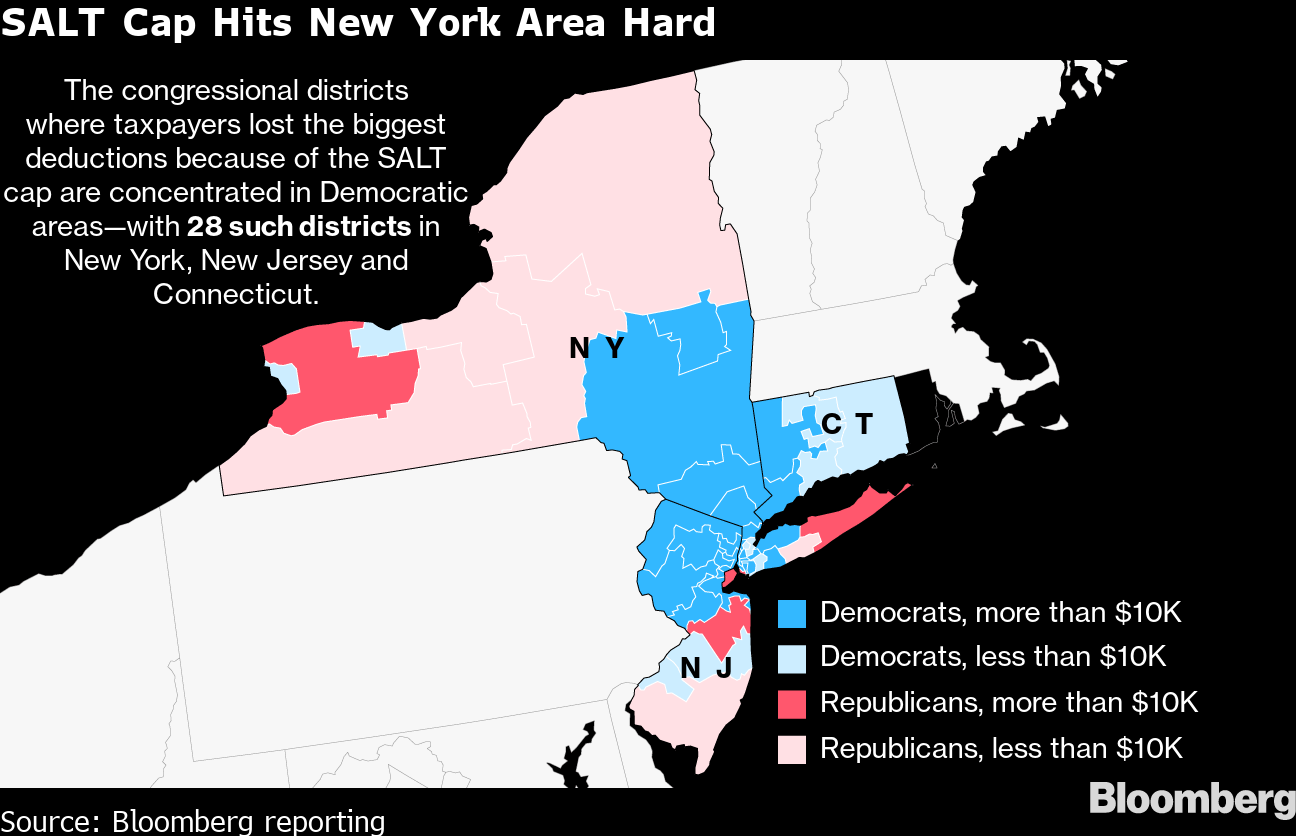

Republicans had slashed the SALT deduction to 10000 in their 2017 tax cut bill a move that some Democrats derided as a partisan revenge mission against high-tax blue states like New York New. The push backed by Gov.

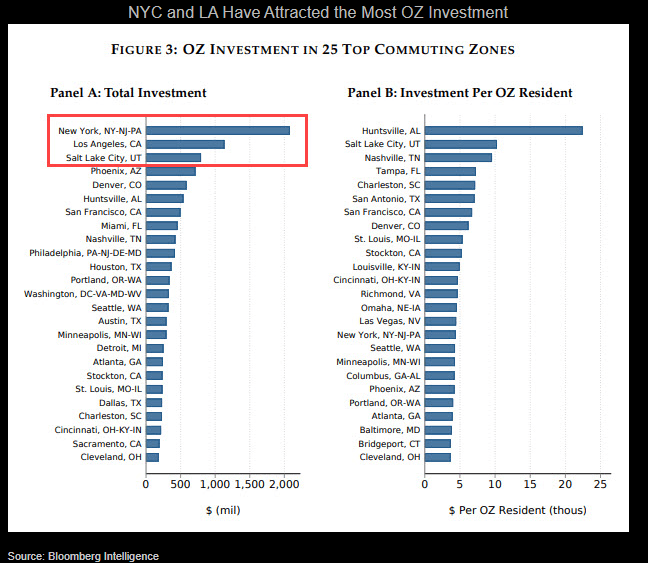

Salt Deduction Redux May Spark High End Spend Opportunity Funds Bloomberg Professional Services

The fiscal 2022 Senate Democratic budget proposal released on Monday calls for SALT cap relief.

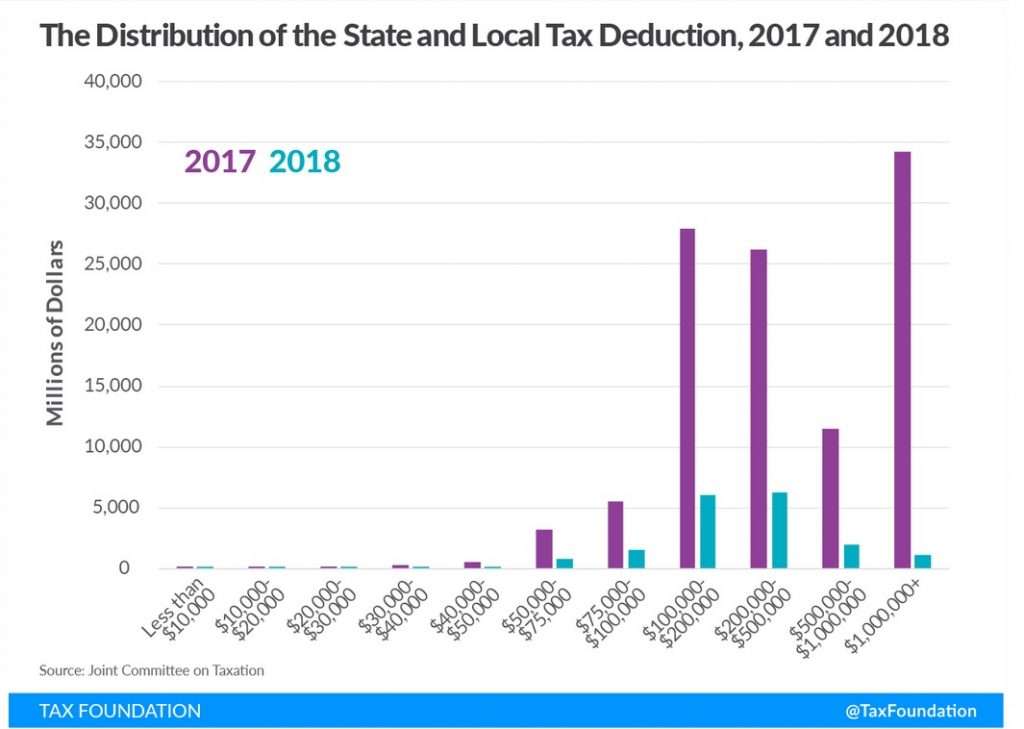

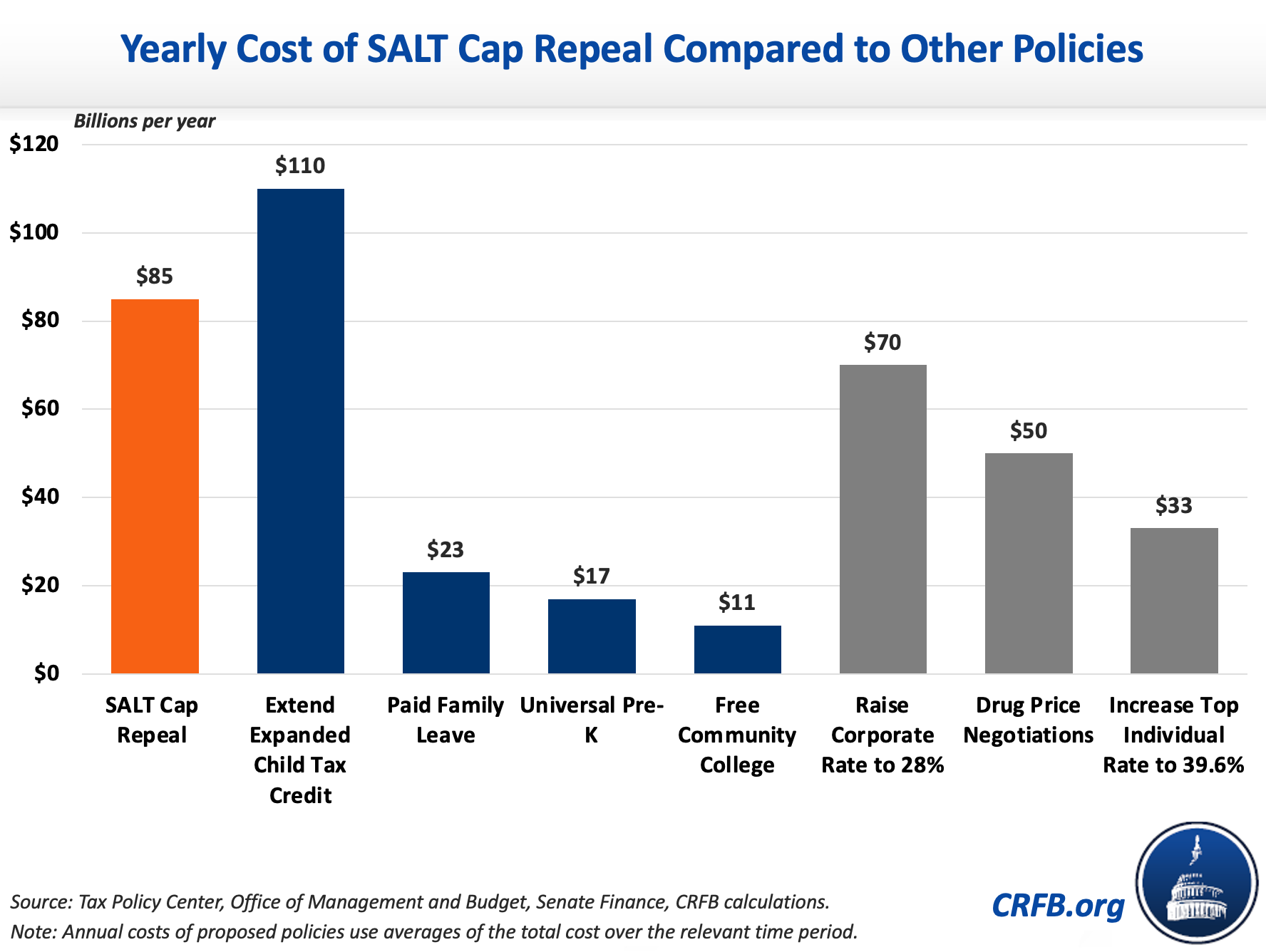

. August 9 2021 833 AM 3 min read. A bi-partisan group of county leaders from around the state joined with Congressman Tom Souzzi D-Long Island Queens and the New York State Association of Counties NYSAC on April 28 to call for an end to the cap on the deductibility of state and local taxes known as SALT. The SALT limit deduction brought in 774 billion during its first year according to the Joint Committee on Taxation and a full repeal for 2021 may cost up.

The period to opt-in to the New York PTET has ended for tax year 2021 but for tax years 2022 and later an eligible entity may opt in on or after Jan. A Democratic proposal aims. Counties call for repeal of SALT cap.

The elective tax does not have an expiration date concurrent with the sunset of the federal SALT cap. It would repeal the SALT cap for three years while raising the top income tax rate. October 05 2021.

Connecticut and New York have revived their efforts to overturn the SALT cap the federal deduction for state and local taxes that. Repealing the SALT cap in 2021 would reduce federal income tax liability by approximately 91 billion or 72 percent. They wont really count when the 10000 cap on state and local tax deductions is repealed by Congress.

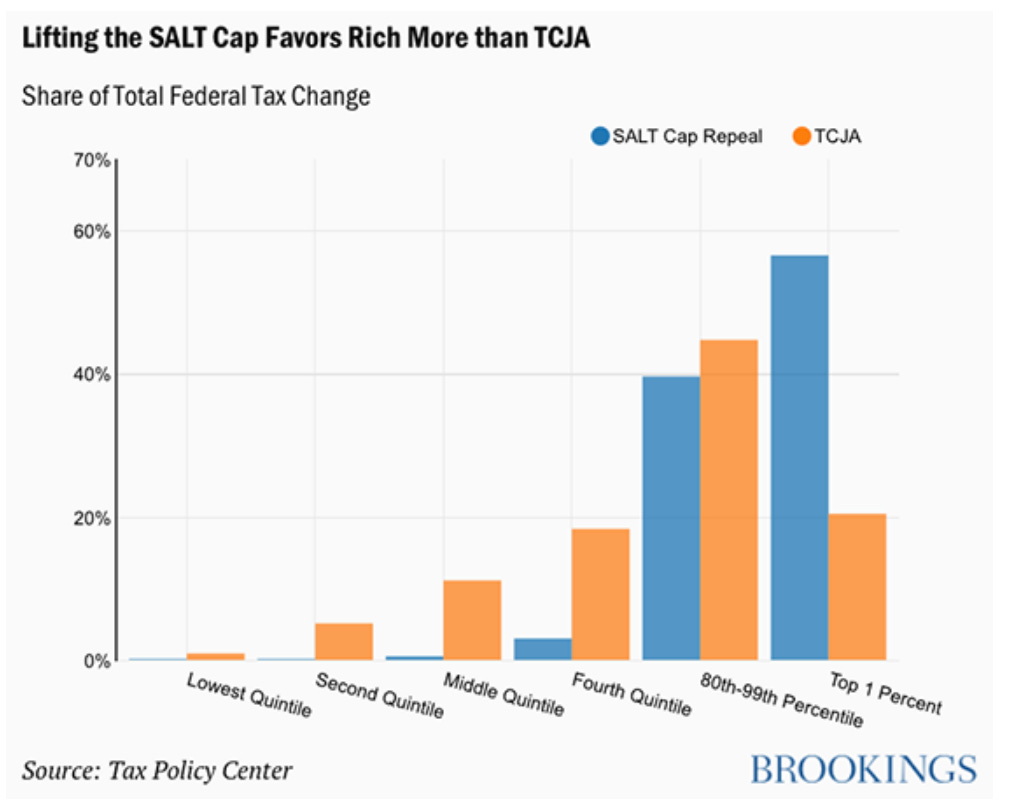

A new bill seeks to repeal the 10000 cap on state and local tax deductions. Is leading a drive in Congress by a group of lawmakers from New York and other high-tax states to raise the 10000 cap on state and. D emocratic leadership outlined plans Monday to bypass GOP filibusters to alter the cap on deductions for state and local taxes paid a tax break largely for the wealthy opposed by most Republicans and some Democrats.

New York seeks Supreme Court review of SALT cap. New Guidance Affected Industries and What to Know Before the October 15 2021 Deadline. New York was hit first and hit hardest by the pandemic and as a result it lost over 1 million jobs in 2020.

That was bad news for top earners in blue states such as California and New York. Paying a state income tax of 10 percent or more. Democrats from high-tax states like New York New Jersey and California have spent years promising to repeal the cap and are poised to lift it to 80000 through 2030 before reducing it back to.

As members of the New York Congressional Delegation we urge you to insist on full repeal of the limitation on the State and Local Tax SALT deduction passed by Congress in 2017 and signed into. New York House Democrats press for repeal of SALT deduction cap. Whats worse is that the law disproportionately hurts Democratic states like New York.

New York state on Monday made another attempt to overturn the 10000 cap on state and local tax deductions amid broader efforts in Congress to raise the ceiling and undo part of a 2017 tax law. Congressman Tom Suozzis D-Long Island Queens efforts to repeal the cap on the State and Local Tax SALT deduction continues to gain momentum this time with the New York Daily News Editorial Board noting how Suozzi is absolutely right to stick to his No SALT No Deal demand in refusing to support any changes. Residents of New York take the highest average deduction for state and.

Americans who rely on the state and local tax SALT deduction at tax time may be in luck. September 29 2021. But the Tax Cuts and Jobs Act limited that deduction to 10000.

New York is taking another run at repealing SALT cap. SALT-Cap Repeal Leader Tom Suozzi to Run for NY. The federal Tax Cuts and Jobs Act of 2017 eliminated full deductibility of state and local taxes SALT effectively costing New Yorkers 153 billion.

That law the Tax Cuts and Jobs Act of 2017 did cut taxes for some but increased taxes on many not rich homeowners in certain states notably New York where it costs people an extra 12 billion. 11 rows New York Taxpayers. Andrew Cuomos spin on the tax hikes in the state budget approved this month is this.

Residents of New York and other high-tax states were hit by a new limit on state and local tax deductions. Kathy Hochul and Attorney General Letitia James was also supported by Connecticut. Recently NYSAC sent a letter.

Repeal of the SALT deduction limitation would be important at any time but as New Yorks residents and economy continue to recover from the impact of COVID-19 it has become imperative. 1 but no later than March 15 of the tax yearie by March 15 2022 for the 2022 tax year. Under the Trump administration Washington launched an all-out direct attack on New Yorks economic future.

Blue-state Democrats have been fighting since 2017 to repeal a key provision of President Trumps tax plan that penalized high-cost California filers. Seventeen of 19 House Democrats from New York said on Tuesday that they will. New Yorks SALT Workaround.

Tax Fairness for All Americans. The Tax Cuts and Jobs Act of 2017 TCJA set a limit on the amount of state and local taxes SALT that people can deduct from their federal taxes. But its not entirely clear when or if that cap put in place as part of the 2017 federal tax.

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

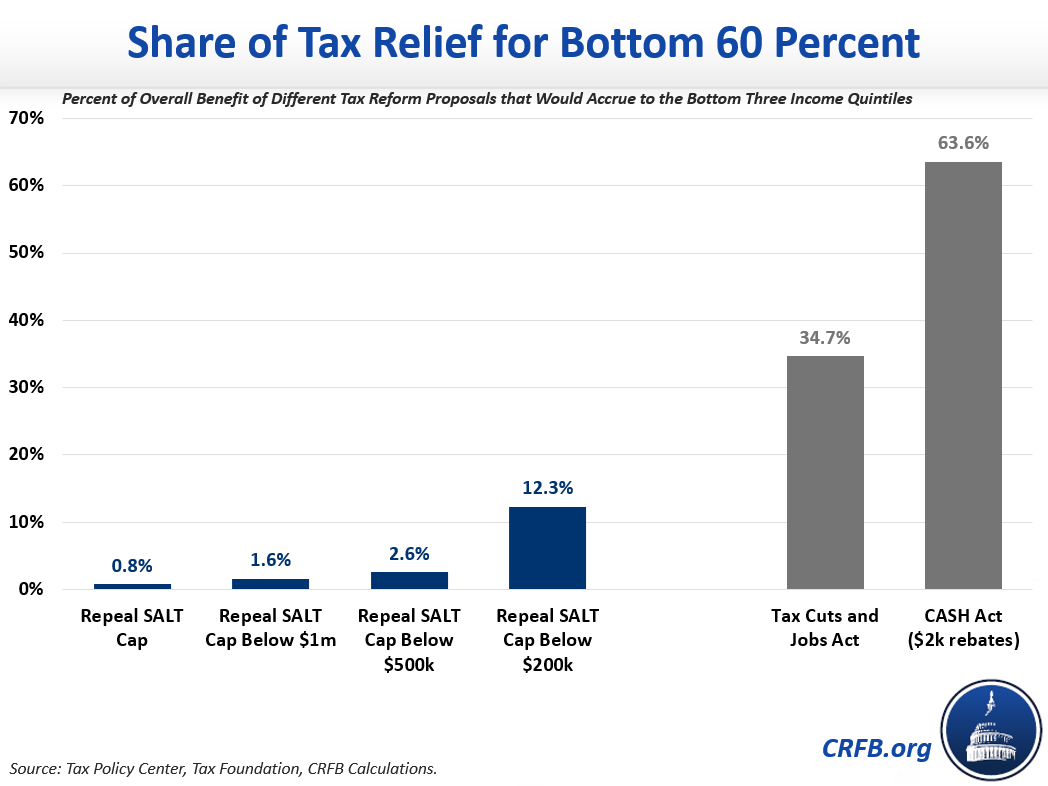

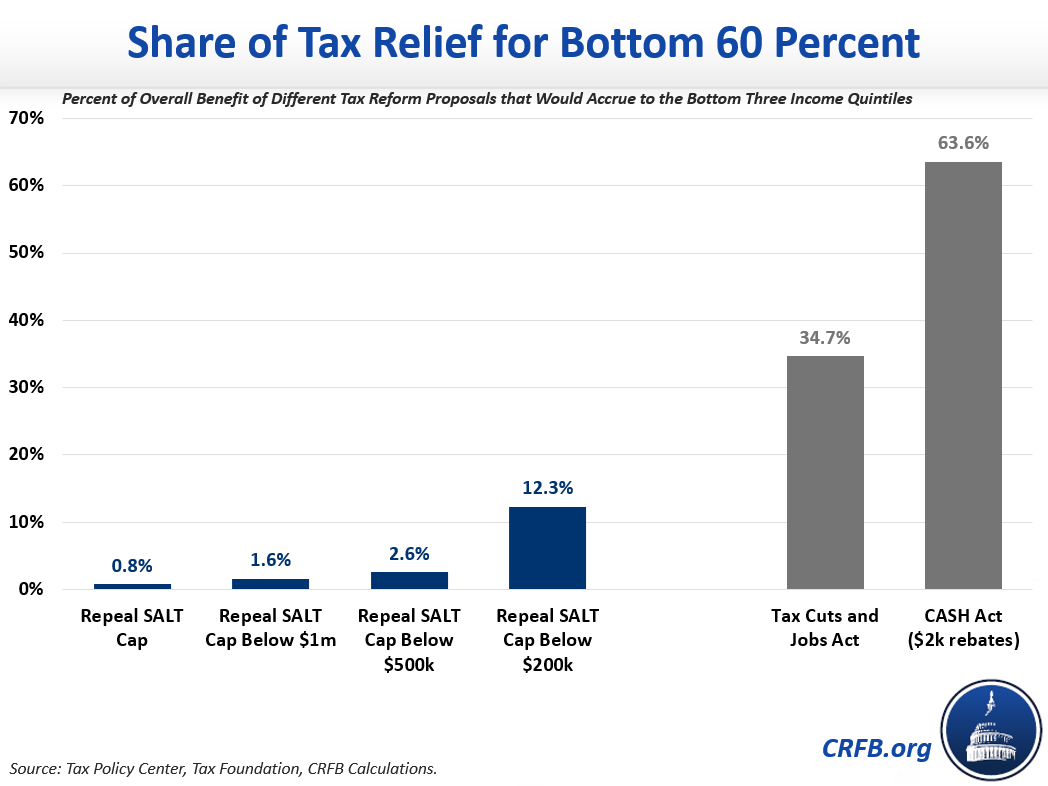

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Salt Cap Revolt Led By N Y Democrats Snarls Biden Spending Plan Bloomberg

Eat The Rich House Democrats Plan To Pass Huge Tax Break For Wealthy Homeowners

The Heroic Congressional Fight To Save The Rich

Two Thirds Of Millionaires Get A Tax Cut Under Build Back Better Due To Salt Relief Committee For A Responsible Federal Budget

Tax Me I M From New Jersey Wsj

Salt Cap Repeal Disproportionately Favors Wealthy People R Neoliberal

The Salt Deduction The Second Biggest Item In Democrats Budget That Gives Billions To Rich The Washington Post

Salt Break Would Erase Most Of House S Tax Hikes For Top 1 Bloomberg

The Democrats Fiscal Policy Makes A Mockery Of Their Progressive Pledges The Economist

How An 80 000 Salt Cap Stacks Up Against A Full Deduction For Those Making 400 000 Or Less

What Is The Salt Cap And Why Do Some Lawmakers Want To Repeal It

A 25 000 Salt Deduction Cap Would Be A Modest Improvement Over The House S 80 000 Version

Salt Cap Repeal Would Be A Costly Mistake Committee For A Responsible Federal Budget

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/9551427/distribution_repeal_SALT.png)

The State And Local Tax Deduction Explained Vox

Dems Somehow Pretend This Mostly Helps The Middle Class The Daily Postercommentsharecommentshare